Condo Insurance in and around Bristol

Welcome, condo unitowners of Bristol

Quality coverage for your condo and belongings inside

- Pennsylvania

- New Jersey

- Delaware

- Maryland

- Bucks County

- Montgomery County

- Langhorne, PA

- Newtown, PA

- Yardley, PA

- Morrisville, PA

- Bristol, PA

- Croydon, PA

- Levittown, PA

- Ambler, PA

- Chalfont, PA

- Doylestown, PA

- Horsham, PA

- Ft. Washington, PA

- Philadelphia, PA

- Maple Glen, PA

Home Is Where Your Condo Is

Your condo is your safe place. When you want to take it easy, laugh and play and catch your breath, that's where you want to be with the ones you love.

Welcome, condo unitowners of Bristol

Quality coverage for your condo and belongings inside

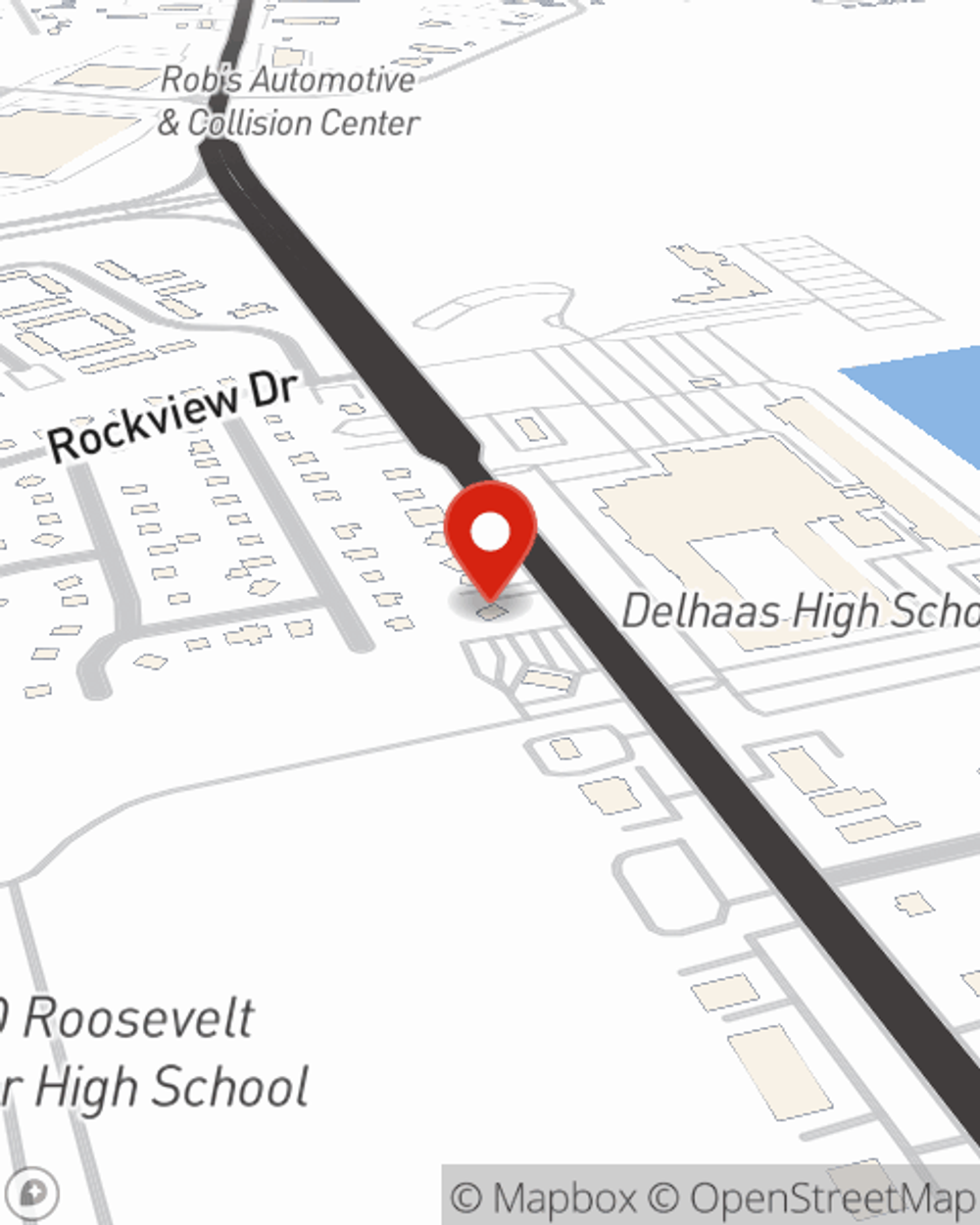

Agent Jeffrey T Hughes, At Your Service

You want to protect that unique place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as smoke, vehicles or hail. Agent Jeffrey T Hughes can help you figure out how much of this wonderful coverage you need and create a policy that works for you.

Don’t let the unexpected about your condo make you unsettled! Visit State Farm Agent Jeffrey T Hughes today and explore how you can benefit from State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Jeffrey T at (215) 757-6900 or visit our FAQ page.

Simple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Jeffrey T Hughes

State Farm® Insurance AgentSimple Insights®

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.